Credit reports

So, here we go again, another data breach. This is not the first one, and, unfortunately, this won’t be the last one. In an age of seemingly endless data breaches, the responsibility for protecting your identity increasingly falls to you. But what if there was a simple, yet powerful, tool to shield yourself from the most damaging consequence: fraudulent credit applications?

One of the main risks with identity theft is the ability for a bad actor (e.g., a fraudster or identity thief) to impersonate a person and obtain credit either from a bank or from a vendor like an energy or telecommunications supplier. Identity theft targeting credit can be devastating because a fraudster can open numerous accounts in your name, such as credit cards, personal loans, or even utility connections, without your knowledge. When these fraudulent accounts go unpaid, it quickly leads to serious negative entries on your credit report, like defaults and missed payments, which will severely damage your credit score. This can then prevent you from getting approved for legitimate loans (like a home loan), securing rental properties, or even signing up for a new phone plan, all while forcing you into long, stressful legal battles to prove your innocence and remove the fraudulent activity from your record.

The good news is there is a relatively simple way to significantly reduce the risk of that happening - monitor and/or lock your credit report.

Your credit report is an essential document that provides a snapshot of your financial history, particularly concerning how you’ve managed credit. In Australia, if you’ve ever applied for a credit card, a personal loan, a home loan, or even a mobile phone plan, chances are a credit report exists about you. It’s a vital tool for lenders to assess your creditworthiness and decide whether to offer you credit and on what terms.

A comprehensive Australian credit report contains a wealth of information. This typically includes your personal identification details like your name, date of birth, address history, driver’s licence number, and employer. Beyond identification, it delves into your credit accounts, detailing the type of credit (e.g., credit card, home loan, personal loan), the credit provider, the credit limit, and the opening and closing dates of the account. A crucial component is your repayment history, which shows a 24-month record of whether you’ve made your minimum payments on time. Missed payments (not made within 14 days of the due date) and serious credit infringements (defaults of $150 or more that are 60 days overdue) are also recorded. Furthermore, your credit report lists credit applications you’ve made, any bankruptcies, debt agreements, or court judgments, and even instances where credit providers have requested to view your report. Since July 2022, information about financial hardship arrangements can also appear, showing that an arrangement was made, but not the specific details or reasons.

Credit reports are primarily used by credit providers – such as banks, credit unions, and finance companies – to assess your credit risk when you apply for a new loan or credit product. They use the information to determine how likely you are to repay debt, which influences their decision on whether to approve your application, the credit limit they offer, and the interest rate. Beyond lending, some utility companies and telecommunications providers may also check your credit report before offering services. It’s also a valuable tool for individuals to monitor their own financial health and detect any potential identity theft or errors on their file. You are entitled to a free copy of your credit report from each agency every three months, or more frequently if you’ve been refused credit.

In Australia, there are three main credit reporting agencies (also known as credit reporting bodies or CRBs) that collect and maintain this crucial financial data:

Regularly obtain and review your credit file

Each of those agencies has solutions to monitor your credit report for a fee. However, what many don’t know is you have the right to access your credit report for free once every three months. You can also request a free copy if you’ve been refused credit within the last 90 days or your credit-related personal information has been corrected on your file. The option to obtain your credit file for free often is not easy to find. To make it easier, here are the direct links to request your free report:

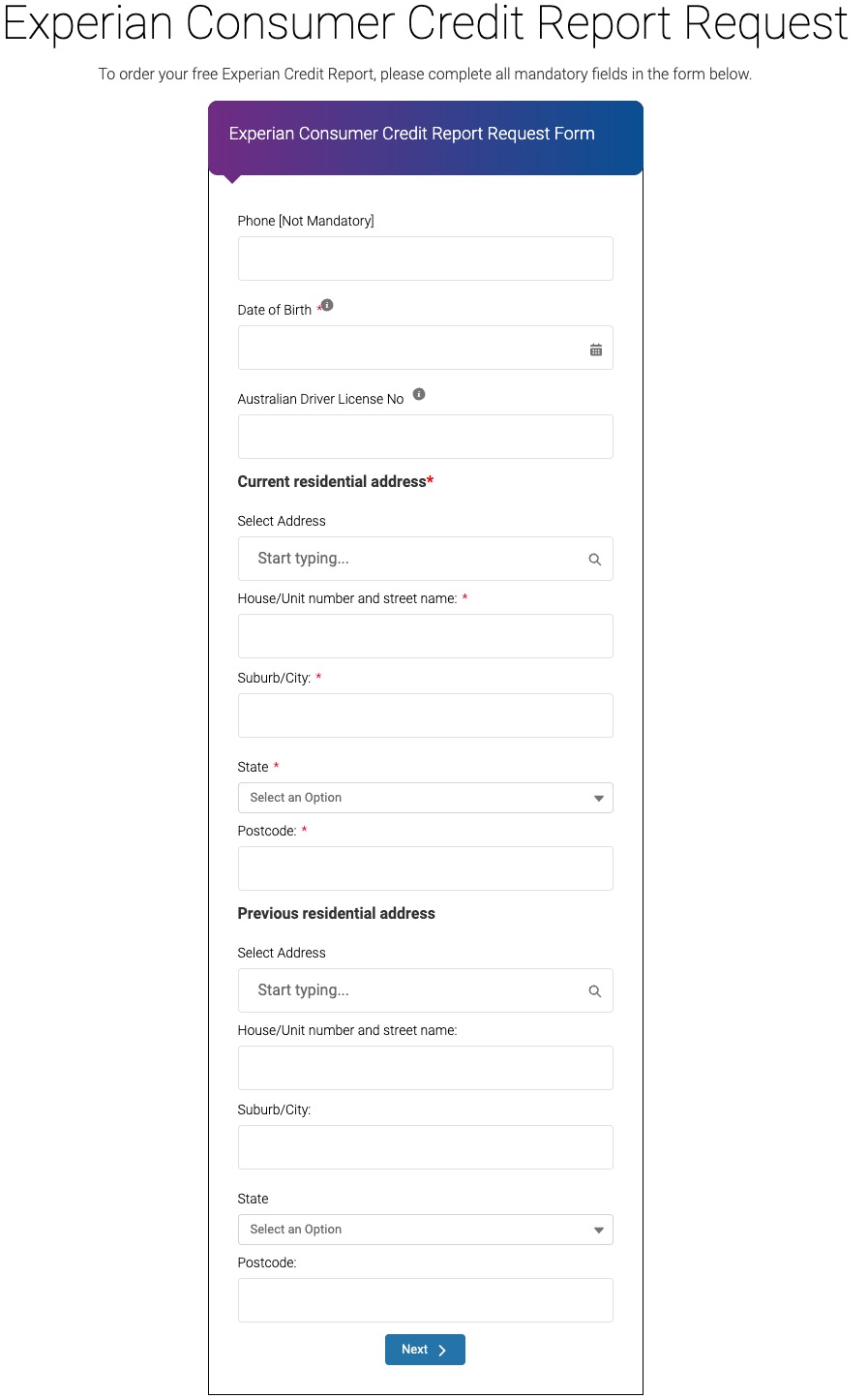

You will have to provide some personal information, like birthday, current and previous addresses, employer names, driver licence number, etc.

Once the request is completed, depending on the CRB, it takes between a few minutes to a day to receive the report.

So what should you do once you get the report?

- Check whether all the information in the report is correct: name, birthday, driver licence number, known addresses, employer.

- Credit accounts: is there a loan or a credit card that you don’t recognise, wrong limit, wrong opened/closed dates?

- Repayment history: is there any missing or late payment? I always pay my credit card balance in full at the end of the month. So it was a surprise to me when I found a missed payment in my credit report a few years ago. Eventually I found out that a charge was made to a credit card after it was already cancelled. It took a number of calls with CBA and a few months to sort it all out. Note here, the CRB does NOT modify the records; instead, the financial institution that initially reported a missing payment would have to contact the CRB to update that.

- Credit enquiries: Review all requests from lenders when you’ve applied for credit. Ensure every enquiry corresponds to an application you actually made. Multiple enquiries in a short period can negatively impact your ability to get a credit, so it’s important to verify their legitimacy. Don’t be concerned by “soft enquiries” (e.g., when you check your own credit report, or when a lender you already have an account with reviews your file). These don’t impact your score.

- Public Record Information: check for any records of bankruptcy or court actions and whether those are valid.

Lock your credit file

While regularly checking your credit report may alert you to problems that have already happened. If it’s a loan taken in your name - you will have to involve the bank, police, and spend time sorting that out. In order to prevent it in the first place, you can lock (place a ban, to be exact) your credit report so no one can access it in the first place. The Privacy Act requires ‘reasonable grounds to believe you have been or are likely to be the victim of fraud’ to place a ban. This often includes being impacted by a data breach (even if not directly you, but a service you use), suspicious communications, or the loss of personal identification documents. The challenge though (and what annoys me the most) is there should be a reason to request it.

You need to contact all three major Australian CRBs to ensure the ban is placed across the board. While some CRBs offer to pass on your request to the others, it’s best practice to confirm with each individually to be certain:

After providing the required information, CRB will place a ban on your credit report for 21 days. Closer to the ban expiry, you will be able to extend it for 12 months. During this time, your credit report cannot be disclosed to credit providers without your explicit consent, or unless legally required. The CRB will notify any credit provider who tries to access your file that a ban is in place. As a result, no one (including you) will be able to obtain any credit under your name.

The downside is if you are planning to refinance your mortgage, get a new credit card or switch electricity suppliers, you will have to remove the ban. And do all of the above all over again once the application for credit is complete.

Final words

I personally see no reasons for not banning your credit report. By keeping it available to any credit institution, and with a lot of private data exposed in various breaches, the benefit of having it locked and non-accessible for any credit applications heavily outweigh the downside of “un-banning” it once in a while (come on, how often do you apply for a new loan?!). If it’s up to me - I would make it a part of MyGov, i.e. with layers of authentication, 2FA, etc., but that’s a discussion for another beer ;)

If you skipped most of the above, here’s the main point: SET UP YOUR CREDIT REPORT BAN! NOW!